CPF accrued interest is the interest that would have been earned on CPF funds that were withdrawn to purchase a property. It’s calculated monthly and compounded annually.

♦ How it’s calculated

– The interest rate is based on the current CPF Ordinary Account (OA) interest rate.

The accrued interest is calculated on the principal amount withdrawn for housing.

♦ When it’s paid back

– When a property is sold, the accrued interest is refunded to the CPF account along with the principal amount.

This ensures that the retirement savings are replenished.

♦ Why it’s important

– Accrued interest can grow over time, depending on how long the funds were used for housing.

If not managed properly, it can reduce the amount available for future needs or other property investments.

♦ What it means

– When CPF funds are used for housing, the funds are essentially borrowed from the future self.

The government pays a competitive interest rate on CPF savings.

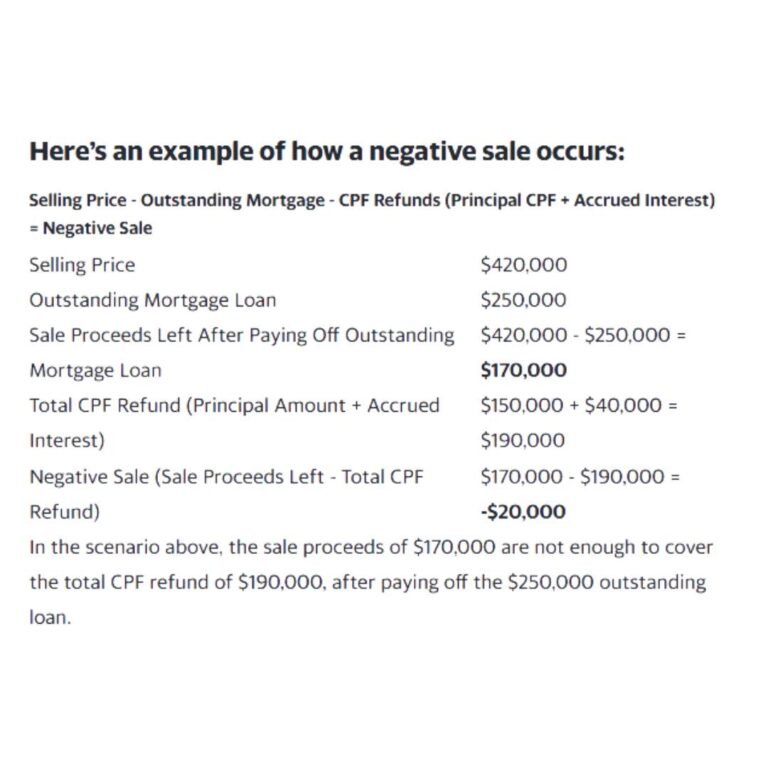

And Here’s what gets interesting when the sales proceeds from selling your home is insufficient to cover the full CPF refunds…

So what is a Negative Sale?

If the sale proceeds of your property, after clearing off your outstanding mortgage loan, are insufficient to cover the full CPF refunds (Principal Amount used + Accrued Interest), it is what we call a ‘negative sale’ or ‘negative CPF sale’.

Not to worry though, however you need to take note that:

If the sale proceeds (including the deposit) after clearing off your outstanding housing loan are not enough to make the required CPF refund, you do not need to top up the shortfall in cash, provided the property is sold at market value or higher.

In other words, the shortfall is waived as long as you have sold the property at market value.

All the cash monies that you have received as the Deposit (Option fee + Option Exercise fee), have to be refunded to your CPF account before the completion of the sale transaction.

3 ways to avoid making a negative sale

♦ Pay your home loan in cash, not with your CPF

♦ Choose a bank loan with a lower interest rate

♦ Don’t hold on to the property for too long

Whether you’re using CPF to buy your dream home or planning your retirement, understanding accrued interest is crucial to making informed decisions.

if you’re unsure, let’s have a chat.

We can explore options to safeguard your future.

https://wa.me/6592215877

Don’t let lack of planning quietly eat away at your retirement plans.